Protect Your Structure: Trust Foundations for Durability

Protect Your Structure: Trust Foundations for Durability

Blog Article

Safeguarding Your Assets: Trust Structure Know-how at Your Fingertips

In today's complex economic landscape, ensuring the security and development of your properties is extremely important. Count on foundations offer as a cornerstone for protecting your wealth and heritage, giving a structured technique to possession protection.

Value of Depend On Foundations

Trust fund structures play a vital role in establishing reputation and fostering solid relationships in different expert setups. Building trust is essential for organizations to prosper, as it creates the basis of successful collaborations and collaborations. When trust fund is present, people really feel extra confident in their communications, causing raised productivity and efficiency. Trust foundations function as the foundation for ethical decision-making and clear interaction within companies. By focusing on count on, businesses can develop a favorable job society where employees feel valued and respected.

Advantages of Expert Guidance

Structure on the foundation of rely on expert connections, looking for specialist advice provides vital advantages for individuals and companies alike. Expert assistance provides a wide range of understanding and experience that can assist browse complicated monetary, lawful, or tactical difficulties with simplicity. By leveraging the experience of professionals in numerous fields, individuals and companies can make informed choices that align with their objectives and desires.

One significant benefit of professional support is the capability to access specialized understanding that might not be conveniently offered otherwise. Experts can provide insights and point of views that can result in innovative solutions and possibilities for growth. Furthermore, working with professionals can help mitigate risks and uncertainties by giving a clear roadmap for success.

In addition, specialist assistance can conserve time and sources by improving procedures and staying clear of costly blunders. trust foundations. Specialists can provide tailored advice customized to details needs, ensuring that every decision is well-informed and tactical. Generally, the advantages of professional assistance are multifaceted, making it a useful possession in securing and optimizing assets for the long term

Ensuring Financial Safety

Guaranteeing economic safety and security entails a multifaceted approach that encompasses numerous elements of wealth monitoring. By spreading investments throughout different asset classes, such as stocks, bonds, real estate, and products, the threat of substantial monetary loss can be reduced.

In addition, keeping a reserve is necessary to safeguard against unforeseen expenses or revenue interruptions. Professionals advise establishing apart 3 to six months' well worth of living expenditures in a fluid, easily obtainable account. This fund functions as a monetary security internet, supplying satisfaction during stormy times.

On a regular basis reviewing and adjusting monetary strategies in reaction to changing scenarios is also vital. Life events, market fluctuations, and legislative modifications can influence financial stability, highlighting the importance of continuous evaluation and adaptation in the pursuit of lasting monetary safety and security - trust foundations. By carrying out these you can check here techniques thoughtfully and continually, people can strengthen their economic ground and job in the direction of an extra protected future

Guarding Your Assets Effectively

With a solid foundation in area for economic safety with diversity and emergency fund upkeep, the following important step is securing your properties effectively. One effective technique is asset appropriation, which entails spreading your financial investments across numerous asset classes to decrease danger.

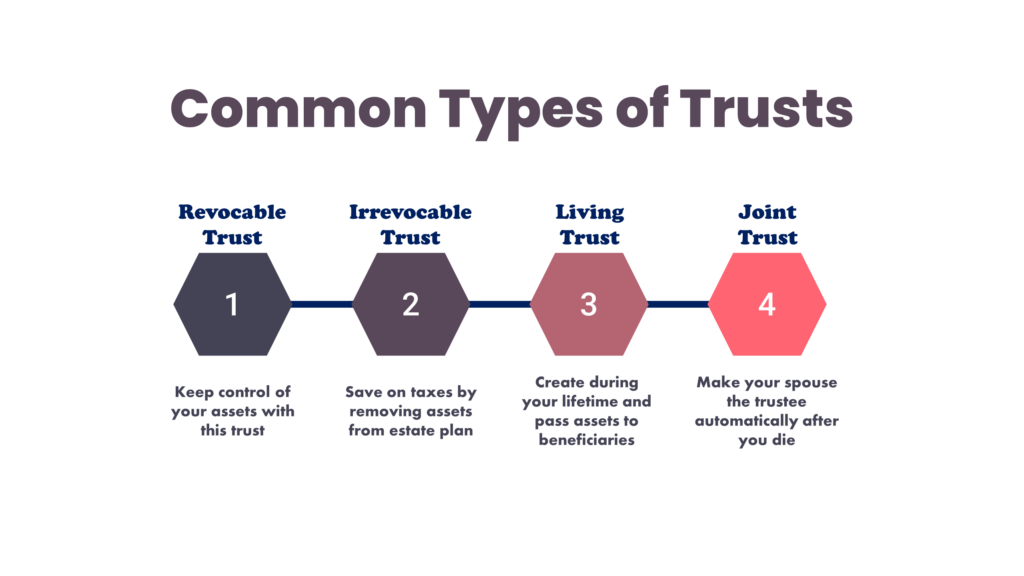

Additionally, establishing a depend on can use a protected means to safeguard your properties for future generations. Counts on can aid you regulate just how your assets are distributed, minimize estate taxes, and safeguard your wealth from financial institutions. By implementing these methods and seeking expert guidance, you can protect your possessions effectively and protect your monetary future.

Long-Term Property Defense

To guarantee the enduring security of your wealth against prospective threats and unpredictabilities with time, strategic planning for long-term asset security is necessary. Long-lasting asset protection includes carrying out measures to guard your properties from different threats such as economic declines, legal actions, or unforeseen life events. One vital aspect of long-term property security is establishing a trust fund, which can use considerable advantages in shielding your properties from financial institutions and legal disputes. By transferring ownership of properties to a depend on, you can secure them from prospective risks while still retaining some degree of control over their monitoring and distribution.

In addition, expanding your financial investment profile is one more crucial approach for long-term asset protection. By taking a positive approach to lasting asset security, you can protect your wide range and give economic protection for on your own and future generations.

Final Thought

In final thought, trust fund foundations play a critical role in safeguarding assets and making certain monetary safety and security. Specialist support in establishing look here and handling trust structures is essential for long-lasting property protection.

Report this page